Highlight:With the current economic times, the Stainless steel market is increasingly becoming dynamic. In this regard, various movements are expected in the prices of stainless steel, molybdenum, nickel as well as scrap. Moderate variations are anticipated in global chrome markets based on the changes that took place between January and February 2017.

Ferrochrome prices spotted to ease but expecting march rebound

The market is projected to experience new developments that will favor the consumers. In the recent weeks, the prices in chrome ore markets have stabilized. For instance, the South African ore is still being sold at approximately $396/tonne cif China since early December.

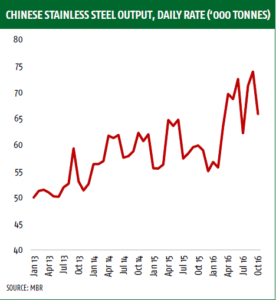

The stabilization and weakening of the chrome ore market have been highly attributed to the demand levels witnessed from the Chinese ferrochrome smelters. In the month of January, deliveries of ferrochrome from Chinese stainless steel mills faced lower price offers. That is because the stainless steel mills are now adequately stocked with ferrochrome in readiness for the Chinese New Year Holidays which are characterized by slower market activity. This period will see various companies in China reduce their production levels and undergo maintenance operations.

However, during the month of March/ April demand is expected to rise depending on the supply response from the chrome market as well as targets on the Chinese Stainless Steel for this year.

Contrary to the weakening of ferrochrome prices in the recent past, the prices of molybdenum have started the year on a high note. This is an occurrence that has defied predictions of many market analysts. Despite that, molybdenum prices have slightly decreased due to the weak purchasing conditions experienced throughout the Chinese New Year holiday period. On a global scale, the production of molybdenum is expected to increase at a rate of 7. 2% compared to stainless steel whose production is anticipated to rise by 3% subsequently generating 47m tonnes this year.

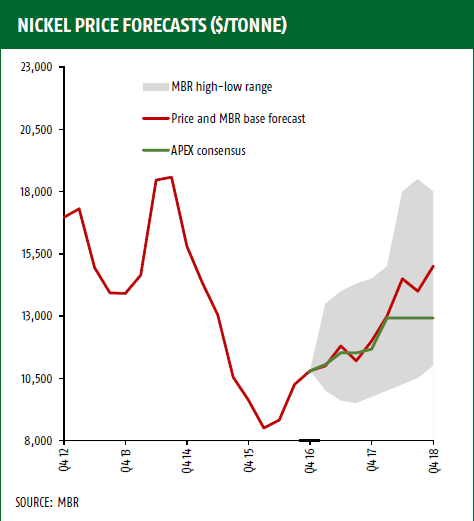

Nickel rallies following mid-late January sell-off however negative factors remain

Indonesia’s decision to lift the export ban on nickel ore drags its prices down. The prices of nickel have been under immense pressure in the recent days with the cost dipping down to $9, 600/tonne. That has compelled some stale long position holders to approve the exportation of nickel ore subsequently reducing the production expenses incurred by China’s nickel pig iron producers. There is a high probability that nickel will be back to the market if the Philippines compensates for the recent shock from Indonesia. As announced by the Indonesian government earlier this month, the proceeds from the sale of nickel might have reduced. That has also been contributed by the laxity of the market is shifting its attention towards increasing the sale of nickel. Still, the situation can be reversed and more nickel is sold if the imminent laws from the Philippines in regards to its mining audits are not implemented. Based on the tough stance from Manila in the last six months, it has been predicted that there are minimal chances that the laws will be enacted. Market conditions also come into play in this situation. Nonetheless, we will also be alert on eye premiums, stocks together with the stainless scrap market to determine how the restocking activity and the stainless capacity ramp-ups are intensifying the pressure within the market.

Chinese 2016 NPI Production Revised Higher

Despite the fact that China’s December NPI production slipped down to the 30, 000-tonne mark due to environmental inspections and subsequent shutdowns, the data obtained revealed that the country finished 2016 with increased output. The overall output of 2016, surpassed the expectations of many market observers by being higher than the previous years. The Q4 figures have also been revised up to 108, 000 tonnes. That is the strongest Chinese NPI production quarter since Q2 of 2015. Additionally, China’s NPI production costs increased from 362, 000 tonnes in the previous year to 375, 000. The increased represents a contraction of 2.3%. That is a significant figure when considering various factors such as the challenges experienced in supplying nickel ore from the Philippines, intensified environmental restrictions as well as the decreasing domestic stocks.

Notably, the 2016 Indonesian NPI production has not yet been finalized as we are waiting for more of Q4 data from various sources. For the full year, our current figure stands at 80,000 tonnes. Conversely, the figure is not on the high side as we had previously thought because high estimates have been witnessed in the past few weeks subsequently surpassing our estimate. By extension, one of the recent estimates includes a figure of 95,900 tonnes that is linked to Chinese Merchant Futures. That clearly demonstrates the rate at which capacity is picking momentum. Remarkably, Chinese Merchant Futures had a similar incremental increase in the previous year of over 65, 000 tonnes as we did. The only difference was the base year where ours was 24,000 tonnes compared to the company’s 30, 600 tonnes.

Scrap Highlights

The prices of nickel have shown a reasonable amount of downside. The decline in nickel prices might be experienced for a little bit longer due to the historical link between LME benchmarks and stainless scrap prices. In as much as the trade of scrap metals is affected by various market and economic factors the behavior in prices between LME benchmarks and stainless steel are due to come to play. The degree of the reduction in sports nickel contract prices on the London Metal Exchange has only increased the US prices whereas no impact has been felt on the European prices. The historical analysis has revealed that there is a close correlation between stainless scrap prices with the monthly average price of LME nickel cash contracts. That is because suppliers of scrap normally tag their prices to nickel which is usually considered to be the most financially valuable metal element. In January, there was a shift in the correlation between scrap and nickel where the m-o-m for the former increased whereas that one of nickel declined.

On the other hand, the US prices have largely been independent of the decrease in nickel prices. It has been recommended that the suppliers have been aggressive in holding onto their inventories so that they can increase prices to US mills with the intention of restocking their inventories. As evaluated, the prices of molybdenum-titanium alloy and chrome have considerably improved, and most stainless mills are looking forward to escalating their prices during this period. That has also seen the disparities between the US and EU prices widen to nearly $270/t.