![]()

Chrome/Molybdenum highlights

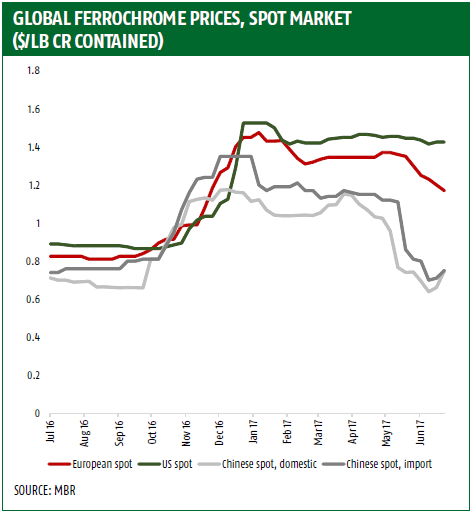

Ferrochrome

Ferrochrome contract prices settled down by approx 30%

The spot prices of chrome in the market are predicted to remain elevated but is expected and for the US scrap prices to reduce just as in the case of Europe in the next moths to come.

While the market awaited the outcome of third quarter negotiations on ferrochrome the tone in the market was that of uneasiness. In the end, contract prices went back in line with spot market prices with reduction of q3 deliveries from $1.54 /lb seen for q2.

Big companies like Glencore and Samancor hold a greater market share in the global ferrochrome market when compared to the initial years. Although during the Q3 settlements there were bearish signs of improved negotiating power, there are expected signs of prices rebound in the coming months.

Ferrochrome imported from China is now trading at 0.75/lb CIF Shanghai down by around 5 cents per/lb. Domestic ferrochrome, on the other hand, is available at some RMB per ton which is in actuality equivalent to just under $0.80/lb

Spot market prices in the USA and Europe are expected to follow Chinese prices(refer graph below)

During the third quarter contract negotiations issues such as cutting of production levels, Chinese steelmakers undertaking maintenance breaks, shifting stainless steel making capabilities to make carbon steels thus making it hard for ferrochrome smelters to note so as to campaign for limited price reductions.

The recent weeks have seen chrome ore prices rebound by $ 245 per ton for Turkish ore and $165 per ton for South African ore, up by $20 per ton since last month.

Factors such as these and many others like the ones below may boost chrome prices;

· Higher electricity tariffs during the South African winter season

· The ongoing strengthening trend in the Rand by 5% against the American dollar since May.

· A boost to the prices of chrome over the future months may result in a Predictable shift within the local ferroalloys production away from ferroalloy smelters given fallen margins.

Molybdenum

Unless the Chinese market is capable of improvement, the international market when it comes to molybdenum should be reduced. The in excess supply of materials from China has resulted in replacing of the South Korean market and therefore leading to the down surge of ferromolybdenum exports from their country of origin thus affecting the US. Apart from the US, this upsurge is apparently affecting the European market with ferromolybdenum prices drastically reducing from $17.80 to $18.50per kg from a Rotterdam warehouse in June initially $20.20to $21.00 per kg in May.

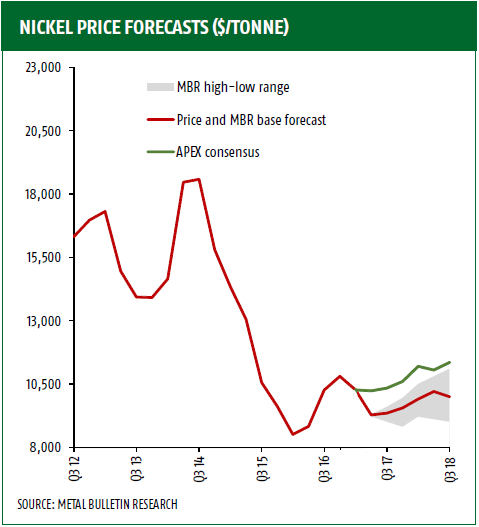

Nickel highlights

Compelling outcome comes with caution

When compared to other metals, the overall outlook of nickel is not appealing proving detrimental to the supply of an NPI and ore. In countries like China, producers have learned a lesson from Tsingshan’s such that they now want to integrate NPI operating facilities with stainless steel plants.

Companies like Xinxing Ductile Iron Pipe Plan a 1m- tpy mill to make 300 series products while Delong’s Holdings intends to set up a 3.5 m- the stainless steel plant. Ideas like these on paper support nickel demand tend to look at it in the positive light in that they are expected to help consume the nickel stock that is overhanging that would, later on, result in increased prices of nickel which is not so true in reality.

Below is the data that was collected according to the report from INSG.

As at last week according to the INSG main topic of discussion was that the global market was at a deficit for the 4th consecutive month with the overall deficit at 22400 tons which is in comparison to the 15300-tonne deficit in the same period and 5200 tons which were in surplus in the year 2016.

According to the INSG, the Philippine mine production changes on a quarterly and as it revises Q1 production down to 12000 tpm to show the year on year decline of 36.3%. It also puts down Q2 production at 32400 tpm which was 3.4% up as from Q2 in the year 2016.

The Philippine monsoon conditions that are favorable for mining in the winter months but a higher Q2 this year, when compared to the previous year, is proof of the high reversal of Regina Lopez’s clampdown policies is expected to play.

There has been the overhang of inventory that of which was equal to 11 weeks of consumption

In China, the number of stocks in total this includes those were unreported reduced by a net 16000 tons. Even with all these deficits, it was all expected given the huge quantity of the market that was oversupplied.

In Indonesia, the NPI alongside with the refined production was at 64000 tons which were up to the first four months which has been increasing 159.5% in every year. A new record was set when the outputs as at April was recorded at 17100 tons.

Scrap highlights

scrap price drop strongly in Europe

With the noticeable sliding in chrome prices, a lot of pressure has been put on the merchants to reflect a reduction in the prices of raw materials that are primary this is especially because of the sliding spot and market prices.

A considerable number of stainless steel merchants from Europe have been affected by the issues that the market from is facing, for instance, the reduction in demand the has led to the high volume suppliers, and this has led to the reduction of scrap prices by 10%.

The market is going through a low phase to the point that merchants had to improve on their discounts to primary raw materials thus making scrap cheap but even this statement is not expected to last long.