Earlier on in the year, investors had a chance to double or triple their money by putting a little portion of it in the steel market when the prices were low. While we hope the story will change in the recent future, the results from surveys conducted in the steel market in Asia, Europe, and America in 2017 show otherwise.

However, the spike in steel prices across the globe was forthcoming following the recent boom in almost all metals. Base metals have skyrocketed in price over the last few months, and even copper, a metal that is less alluring rose by a 20% margin. Regarding the price difference between the three continents mentioned above, USA’s steel is still more expensive than China’s and Europe.

Here is a deeper look at the price of steel during August 2017 and some of the expected changes in price as the year comes to a close.

Asian market – Price Still Rising Amidst Stock Building

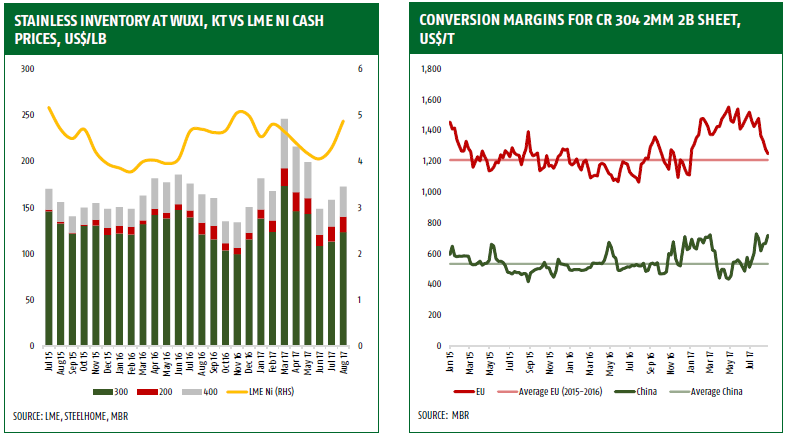

In just a month, the stainless steel stock in Asia has witnessed a significant rise while prices continue to go higher as illustrated in the graph below.

An increase in steelmaker’s margins and improved consumption are partly to blame for the spike in price, but the dramatic draining of inventories in areas such as Wuxi in China also have a part to play. However, mills in China have curbed production at home and intensified steel export despite an increase in output and demand of other metals such as carbon steel, which is about to set a new record.

Still, these interventions are not enough to stop the surge in price with spot prices for CR coils rising to $2,107 per tonne. This figure portrays a $232 increase in just a month, which is the second largest month-on-month rise in ten years. Asian prices rose even further with a tonne going for $2,275; a $290 increase from the previous month.

Prices for the 2mm CR benchmark also rose exponentially from $147/tonne to $1,230 per tonne. Stainless steel consumption saw a 15% rise last year, which prompted the production of more of this metal. However, a 4% drop earlier on in the first quarter of the year seems to have permanently set the course for a free-fall in demand.

A 12% drop in the second quarter also dented Asia’s steel market despite a significant increase in demand for Chinese steel. As shown in the chart, the decline in demand reached its high point in March, which prompted destocking. Recent developments in China are predicted to keep the price rising, which will have the same impact on Asia at large.

American market update – Prices Still on the Rise

Despite the slight increase in domestic demand for steel in America, the price is yet to come down. In fact, US stainless flat roll mills have already announced a surge in stainless steel’s price over September. This statement took many people by surprise considering the increased base prices and the unavailability of master distributor and mill depot stocks.

Functional discounts were reduced by 2% for CR 300-, 200-, and 400-. However, this move also included a 10% increase of functional discounts in polish extras, which saw mill plate prices soar by $60 per short tonne. Many believe the hike in base price will have fractional success at the moment but make good returns in a month or two.

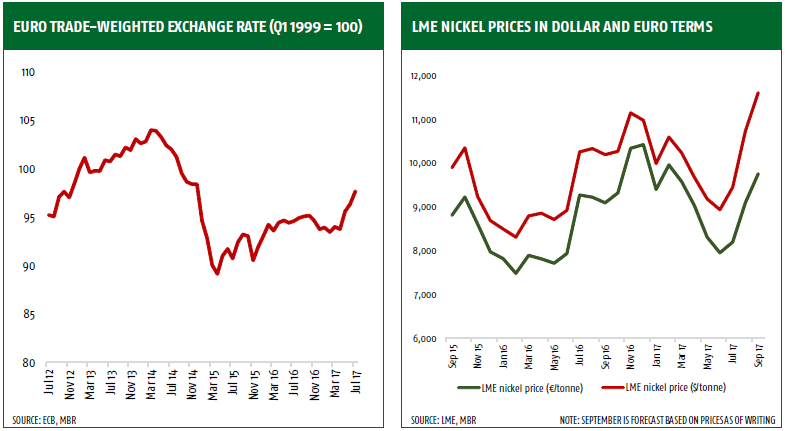

Alloy upsurges in America have also caused the price of stainless steel to soar in August with 3-month LME Nickel jumping to $11,715 per tonne; its highest price in 2017. While this feat might prompt a price correction in the fourth quarter of the year, the price of these materials is expected to keep soaring over the next few months.

Nickel prices are up by 11.8% month-on-month, iron is also up by 2.7%, and molybdenum extras by 12.9%. This rise has caused an 11.3% upsurge in the price of grade 304 stainless to 49.48 cents/lb. However, despite the rise in price over the past few months service centers continue to add to their stock, which balances demand as opposed to three months ago.

As such, the month of August oversaw an increase in manufacturing activity from 63.5% to 60.4%. Just like in the previous month, imports have declined, and the rise in stainless steel exports from America is still steady.

European market update – the Dormant Market

Asia and America might enjoy spiked prices, but Europe will have to wait until the start of the fourth quarter of the year to know their current market cycle pickup. August was relatively quiet in Europe with most of the workforce commencing their holiday period and factories carrying out maintenance breaks. As such, output levels from these companies are lower and as large-volume buyers dwindle.

The rise in price in July was followed by a similar upsurge in August, but the price of steel remains constant at the moment in Europe. Prices for most stainless steel products have also remained unaffected as well as those of alloy surcharges. However, there are buyers rumored to be getting significant discounts on base prices.

Early August saw the drop of these prices by about €10-25 per tonne to €1,055/tonne for grade 304 stainless steel. However, there were places with discounted offers throughout August with a tonne going for €1,000. As the euro strengthens, most stainless steel mills in Europe are clearing their stock and advise buyers to consider them as opposed to importing steel, hence the discounts.

In case imports overshadow domestic consumption, European mills will have a hard time navigating negotiating a better deal for their base prices. To further prevent this incident from plaguing the nation, Europe continues to ban the import of some steel products such as CR flat products from other places, for instance, China.

As far as alloy surcharges are concerned in Europe, nickel prices are up by 13% in writing, but the price remains constant as the Euro strengthens against the dollar. With market activity returning, we are sure to see a different ball game regarding stainless steel prices in Europe before the October.