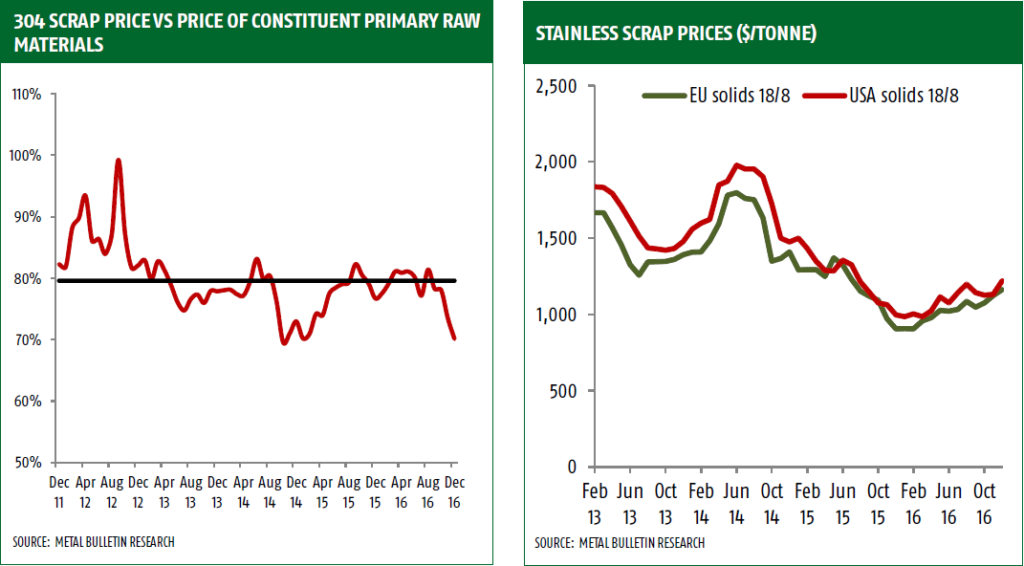

Highlight:It is expected that the price iron and nickel will increase during early 2017, although at a slower rate than that of chrome seen over the past few months. During the same period, the European stainless steel producers have enjoyed high prices due to high demand from buyers. This trend which is also supportive for stainless steel scrap prices is expected to continue up to the second quarter of 2017 where the stainless steel prices and the prices of its major raw materials are expected to slow down, allowing stainless steel scrap prices off to catch up.

Nickel prices stabilize as year ends

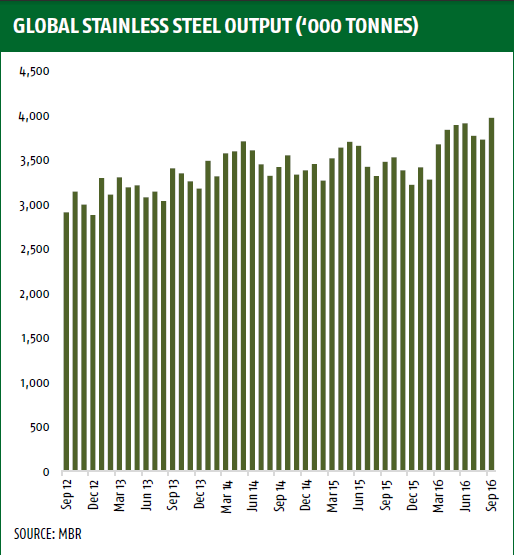

The current Nickel prices are treading in the waters of the $11,000s, only $1000 shy from either breaking into the into new high ground of above $12,000 per tonne or head to the lowest levels of the $10,000s. The market performance of Nickel in 2017 will be influenced mainly by the potential for stainless steel output, which directly affects Nickel demand and the NPI supply chain. The major influencers of the Nickel prices this year will be China and Indonesia which are currently experiencing rapid changes in stainless steel and NPI production capacity.

The European market is currently experiencing stable Nickel market prices and the market indicators show that the stable prices will prevail for some time with both the stocks and the LME spread remaining constant. Over the recent past, both Europe and Asia experienced eased premiums due to a seasonal decline in demand and higher prices. However, this was not the case in the US market; there was a slight increase in premiums in anticipation of a positive start in early 2017 due to improved economic conditions after the country recovered from the election fever.

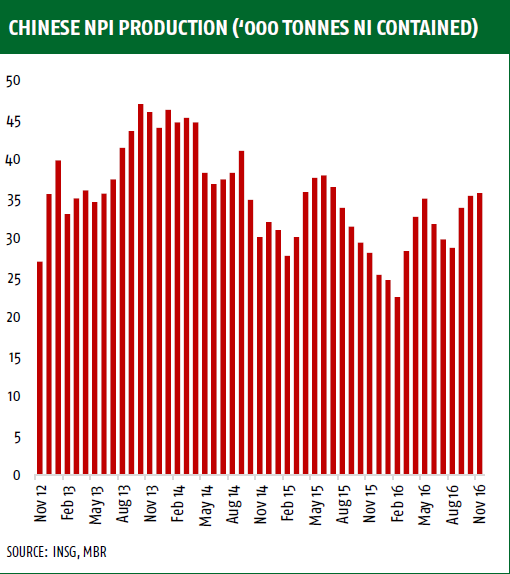

Chinese NPI production still surprising on the upside

According to the latest statistics from Antaike, NPI production in China is still surprisingly on the rise with the month of October seeing a production of 35,300 tonnes of contained nickel, which is 300 tonnes higher than the market projections. In November, there was further production increase by 1% particularly at the RKEF furnaces producing higher grade product – around 35,650 tonnes of product was produced during this month.

It was expected that in the months November and December there would be a decrease in NPI production in line with seasonal patterns triggered by the coke and ore costs. However, this is not the case and is yet another indication of high levels of resilience in the Chinese NPI Industry in terms of production.

In the short run, the Chinese NPI production is expected to run under the recent higher levels, which is consistent with the fact that Jiangsu and Liaoning high-grade producers gave resumed production. Interesting enough, rumor has it that only 20 cargos of laterite ore have been imported from the Philippines to China In November compared to the fact that 56 cargos were imported in the month of November last year. Though these reports are yet to be officially confirmed, there is a high likelihood of decline of production due to the reduced imports.

To maintain the production levels, NPI producers must now depend on their ore reserves on the domestic level until the rainy season in Philippine is over and shipment volumes can resume the normal operation. Reports from Antaike indicate that all the major ports have experienced a major decline in ore stocks by over 1 million tonnes during the month of November, to remain with only 14.03 million tonnes in the reserve. However, the Chinese are confident that they have enough reserves to last them until the spring, especially with the reserves of high and middle-grade ore accounting for over 8 million tonnes of the total ore in reserve.

Despite the fluctuation in the import capacity, Chinese NPI stocks were not adversely affected. By the end of December 2016, the total reserves amounted to 12,600 tonnes, of which low, middle and high-grade NPI was 200, 1,000, and 11,400 tonnes respectively. There was a total of 22,000 tonnes of NPI stocks at the start of January 2017.

Despite the fact that fluctuation in the import will significantly slow down the Chinese NPI production in the short term, its crude stainless steel output, on the other hand, is on the rise to absorb the additional NPI units in the market. However, it is not clear whether this increase will be sustained in the long run due to environmental control by the government that may reduce nickel price growth in a few months.

Chrome/Molybdenum Highlights

Ferrochrome contract prices surge, but spot market stabilizes

The major shift in ferrochrome contract prices has become that the major talking point in global chrome markets, with a price shift of about 50% expected between the last quarter of 2016 and the first quarter of 2017. This shift will increase prices from $1.11/lb to $1.65/lb which in turn will add about $250/tonne to stainless steel prices in 2017.

Both the European and the US markets have already responded to these changes with ferrochrome prices increasing by $1.40/lb in Europe and $1.30/lb in the United States. Interesting enough, the ferrochrome prices in China which are the most important spot market for ferrochrome has remained relatively stable since early December.

Another interesting phenomenon is that the recent increases in chrome ore prices have slowed down compared to price increases seen in the past few months. This might be an indication that we are likely to be at, or close to the pricing peak. These experiences are being felt in various parts of the globe, with South African UG2 ore currently being sold at around S390/tonne if China; which is higher by about around $25-$35 per tonne at a similar time last month although at the same level since early December. In normal times, this should be a normal increase, but when compared to the price increases witnessed in the past few months of about $100/tonne, it is a notable slowdown.

A similar pattern is seen in the market for Turkish ore as well, with prices having shot up by $25 to $35 per tonne to around $435 per tonne in China. Again, however, they have remained at this level since early December. The only contentious issue regards the timing of the market pullback, bearing in mind that such sharp price increases in a matter of months can also crash down at a similar pace causing severe market disruption.

Molybdenum

Molybdenum price has surged in the recent past, as a result of speculative buying in anticipation for an expected further increase in prices. If the expected price increase of steel does not materialize in the next few months, the Molybdenum prices will fall rapidly. Politics and global economic changes will also play a significant role in the prices of Molybdenum. Much of the optimism stems from the stimulus plans of the Chinese government, and the policies that the president-elect Trump will likely enact next year. Major market controls are the appreciation of the US dollar exchange rate and rising financing costs in China, which will promote risk aversion.

Scrap Highlights

Scrap prices are on the rise, with further increases expected

Stainless Steel scrap prices are on the rise once more, as the market adjusts due to increasing in prices of the key raw materials that substitute for scrap, thus making it a cheaper alternative for production. The scrap prices have not been able to keep pace with other stainless steel raw material prices, with the chrome ore and finished ferrochrome prices doubling in the second half of 2016. (Refer chart below)

As such, the stainless steel manufacturers are opting to use scrap presently to manufacture steel, thus pushing its demand higher each day and consequently pushing its prices higher. With the price of the primary raw materials expected to remain high in the first quarter of 2017, the prices of Steel scrap will keep rising as long as it remains the cheaper alternative. However, this situation is expected to reverse course in a few months with chrome prices being already at, or very close to their Peak.