Highlight:2016 has been a good year for the stainless steel marketers in Europe; in fact, it is one of the best since the 2008-2009 financial crises. The European Steelmakers are enjoying good market prices where the prices of steel have been gradually rising throughout 2016. The prices are expected to fall back slightly in the second half of the year, however, they will not have a major impact on European stainless market due to the high negotiation power it has accrued over the past few years compared to other regions.

The year ends on a high

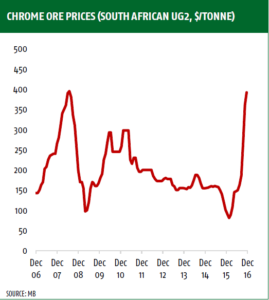

2016 has been a good year for European Steel makers with all the three producers – Aperam, Outokumpu, and Acerinox – having recorded positive net financials; a feat that has not been achieved since 2011. This is in stark contrast to the results of the past few years where the market has been struggling. As 2016 came to a close, the favorable prices have seen the alloy surcharges and base prices of all types of stainless steel at their highest point. Please see below chart clearing depicting the turning point at the beginning of 2016.

These positive changes have been brought about by a consistent increase in the price of nickel, a key raw material in the manufacture of stainless steel. The poor market performance over the past few years had resulted in the low production of steel because manufacturers were worried that, if the prices plummeted further, they would suffer huge losses. Fortunately enough, with the recent turn of events, 2016 has seen a complete market overhaul, with some buyers bringing forward purchases to avoid future price increases.

Nickel is not the only culprit responsible for the changes in the market experienced recently. The rise in the base price and the prices of iron and chrome has also significantly contributed to the price changes in the market with rising chrome cost adding about an extra €30 per ton to grade 304 while iron contributed an added cost of about €50 per ton.

More changes in ferrochrome prices expected to drive the prices further higher. The changes in prices in early 2017 will be mainly affected by the expected further increase in ferrochrome prices with Q1 deliveries set to shoot to $1.65/lb which is about a 50% increase in price. As a result, increasing in chrome prices alone could result to grade 304 alloy surcharges of €200 to €250 per ton.

Stainless steel manufacturers are expected to enjoy the favorable prices for the first half of 2017. During the same period, stainless steel buyers will have to contend with the high prices, but during the second half of the year, they might get some respite though not a lot – the prices are expected to fall significantly during this time. By mid-2017, the industry may experience some decline in alloy prices as the supply response of alloys such as chrome and nickel have already become more available in the market, which will cap the rise of stainless steel.

However, these changes will be minimal due to the fact that stainless steel manufacturers in Europe have a high bargaining power. This is due to the fact that the euro is weakening and that there are currently fewer imports of stainless steel alloys in the region compared to a few years ago; two factors that make imports more expensive thus pushing the price of stainless steel higher.

Chrome/Molybdenum Highlights

Despite Surge in Ferrochrome contact prices, spot market has stabilized.

Ferrochrome

The huge shift of ferrochrome quarterly contract prices has become the major talking point in the global stainless steel market, with its spot prices in both the United States and Europe have significantly increased. As of January 2017, has seen ferrochrome price increases up to $1.3/lb while the USA has experienced price increases of up to $1.4/lb. Interesting enough, the spot prices in China, which is the most significant spot market for chrome, has remained significantly stable from early December to date at $1.35/lb.

Similar patterns of price increases of chrome have been experienced in various parts of the globe such as South Africa, Turkey, and China by $25 – $35 between the Months of December 2016 and January 2017. On normal circumstances, this is considered as a tremendous increase, however, when compared to months of October and November that experienced price increases of up to $100/ton. Thus the slowing pace of price increases in the past few months indicates that the market is at peak or will hit its peak soon enough and the prices will eventually start falling. The question that remains is that, how soon is this pullback, bearing in mind that such sharp price increases in a matter of months can have can also crash down at a similar pace causing severe market disruption.

Molybdenum

Molybdenum price has surged in the recent past, as a result of speculative buying in anticipation for an expected further increase in prices. If the expected price increase of steel does not materialize in the next few months, the Molybdenum prices will fall rapidly. Politics and global economic changes will also play a significant role in the prices of Molybdenum, such as Donald Trump policies and the Chinese government economic plans. The other major factors that will affect the Molybdenum prices include the rise of the Chinese financial cost and the strengthening of the US dollar which will promote risk aversion.

Alloy Surcharge Highlights

December recorded the highest level of alloy surcharges for the year 2016, with these increases expected to flow over to 2017. In January 2017, stainless steel prices are expected to rise by $300 to $350 per ton on all types of steel. The rise of stainless steel prices in this region has been mainly promoted by an increase in the prices of Ferrochrome. From the above statistics, it is clear that alloy surcharges in the United States are rising at a higher level than that being witnessed in Europe – the price increases in Europe range from $80 to $170 per ton. The reason behind this is that the United States uses more chrome than their European counterparts and also, the weakening Euro has further played a significant role.