We required been awaiting those publication about Q3 ferrochrome contract costs with interest, expecting a breakdown starting with Q2 value. In the end, the concurred fall might have been marginally closer on 30%.

US market update – US stainless steel prices to push down further due to declining surcharges

The US market will experience continued fall of transaction prices in the month of July for all major stainless steel grades. The unexpected steep decline of about 30% benchmark price occurred when the chrome spot prices were on the onset of recovery. This was facilitated by the announcement by the Mogale Alloys to close down in July for maintenance proposes. This switchover has made the market prices quite unstable.

Despite seeing an oversupply of ferro-molybdenum, molybdenum prices will experience a 11.2% month¬ on month decline. Nickel also saw a 3.2% decline, though it has started to recover over the past few weeks, with the prices are expected to keep rising. Ferritic grades are witnessing the greatest price declines with grade 430 stainless prices falling to 22.82 cents/lb (27% decline), and grade 409 to 18.62 cents/lb (23.3% decline). Austenitic grades have also seen significant declines with grade 304 raw material prices falling to 43.25 cents/lb (19% decline) while grade 201 fell by 3% to 35.01 cents/lb.

This comes as the US stainless steel market price has leveled due to a decline in alloys prices and also with the domestic mills struggling hold on their end of the bargain. On the other hand, the demand is quite steady in the market where ISM’s new orders index indicated 2% increase while the Institute for Supply Management Manufacturing Purchasing Managers Index indicated a 0.1% increase in demand in May. The auto and the housing industries are currently leading in terms of stainless steel demand. There is a high likelihood that the large-volume stainless buyers have been holding from buying due to the current volatile stainless steel market. There is hope that the industry may see price increases towards the end of the year; however, this is not guaranteed. However, everything could change drastically with the outcome of the Section 232 investigation. The market is hoping for a favorable, broad-based ruling on the kind of tariffs likely to be imposed on the industry and whether stainless products will be included in the quotas.

Asian market update – Falling stock Due to Reduced demand and Production

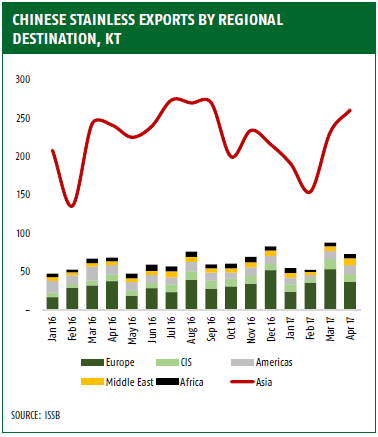

From the Chinese stainless steel exports chart(refer chart above), it is evident that the exports for finished steel, processed steels, and semis such as slab, have rapidly increased since the start of the year. The first quarter has seen 4% increase in export compared to last year’s first quarter. As of May, Chinese export to the rest of Asia and Americas have not seen much growth. However, export to exports to Europe, Russia, and UAE have seen much growth.

80% of the Chinese exports went to Asian markets. However in the first four months of the year, export to Asia reduced by 3%, which was gained in Europe. Other countries that heavily import Chinese stainless steel include South Korea, Taiwan, Vietnam, the rest of South Asia and Italy and Turkey in Europe.

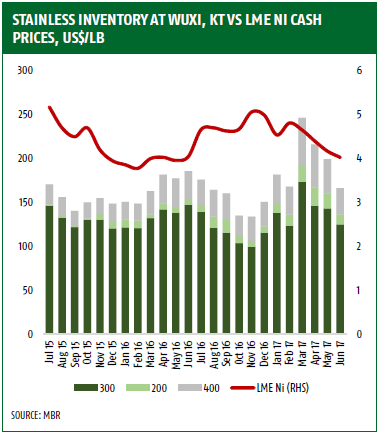

China offers the most competitive exports in terms of price than any other market. This is the reason why the export volumes are still on the rise when prices elsewhere are falling. However, this may change soon enough as Asian import prices are on the rise; the volume of exports is likely to surge within the few months given that that the operations cost for stainless steel producers in China will rise. From the stainless inventory chart, production levels are likely to fall further until mid-June.

The Asian stainless prices have been highly volatile as seen in the ‘Stainless Inventory at Wuxi chart’ (refer above chart) where prices declined at the beginning of the month and recovered towards the end. More price volatility is witnessed in the last week of June, where spot prices of stainless 430 surged by $18/tonne. On the other hand, austenitic stainless steels such as grade 304 ferrochrome fell to $500/tonne which is a decline of about by $69/tonne on the week-on-week basis.

Over the first quarter of the year, Chinese local fundamentals and prices, have been supported by the export market. However, production in this market has been steadily declining in this quarter. Because suppliers have benefited from the reviving export market, the question that begs to be answered is whether the margins have revived enough to support increased production. The trend indicates that the suppliers will no longer benefit from increased exports in the following few months, this will be forced to cut back.

European market update – Prices slip but August will bring even greater falls

July marks the beginning of the stainless steel summer sales in Europe, with the prices beginning to sharply decline. This month will experience extensive price falls of nickel-containing grades of stainless steel slide. The manufacturers are adjusting to these changes in the market by reducing their base prices to entice buyers into the market. Since the end of May, the base prices have reduced by €50-55/tonne, where grade 304 stainless steel prices at €1,080/tonne while grade 316 material goes for 375/tonne.

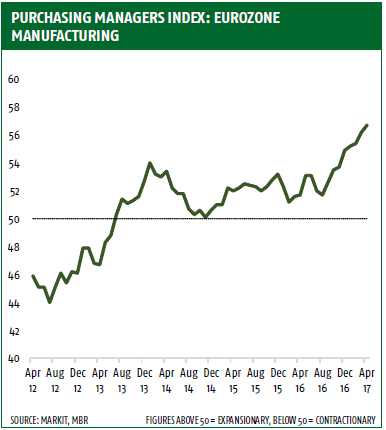

The sharp decline in the cost of raw material in the past few months has been the leading cause of reduced demand from large-volume buyers because they are waiting for the prices to plummet further. A quick analysis of the purchasing managers index chart(refer above chart) will reveal that the July price falls can be considered as trivial given that bigger price falls for all grades of stainless steel are set to come on August.

The ferrochrome prices are set to decline by about 30% from their Q2 level. This will translate in all other grades of stainless steel, with grade 304 stainless steel, for instance, dropping further €150-200/tonne in August. Beyond August and into Q4, the decline in chrome prices is expected to slow down, though nickel prices are expected to remain low only to recover towards the end of the year. While the stainless steel market will recover from these low prices, it is unlikely that they will get back to the Q1 highs.

Thus, the stainless steel manufacturers in Europe are likely to endure tough market conditions in the following quarter. However, once the current buyer stock runs down, the large volume buyers will be forced to return to the market, which will reverse the recent cut in base prices. However, the market is not likely to jump back to the previous glory of the first quarter of the year 2017.